The Future of Money for Manchester?

May 7, 2016

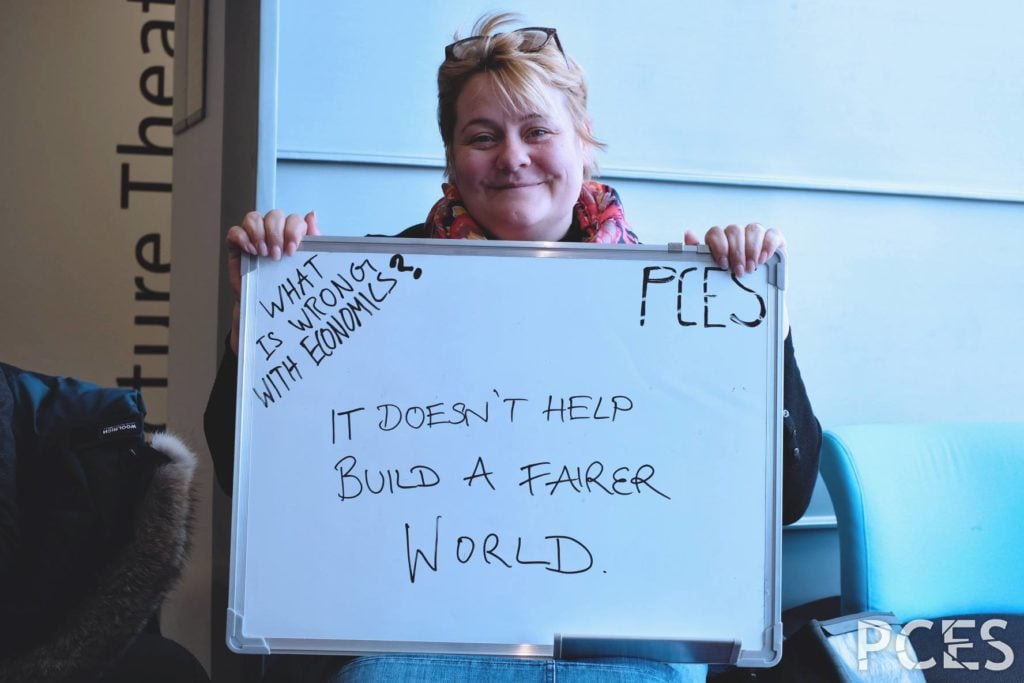

Photo Credit: Post-Crash Economics Society, University of Manchester

The concept of money is stubbornly obscure. We were always pestering mum and dad for it to buy sweets or ice creams whenever Mr Whippy was heard doing the rounds in summer. But we never knew anything more about it other than its capacity to be exchanged for certain goods. It’s so intertwined with human civilisation that we grow up assuming it’s a perfectly natural extension of our existence, without which we would lack the vehicle for procuring the goods and services that we need to survive. We work, we get paid, and we live, simple! But what is money and what does it really mean? Brett Scott is a monetary activist who travels the world critiquing money in the context of its past, present and future use, delving into some of the concepts of alternative economics and what they could mean for the future of money, and how we relate to it.

I attended one of his discussions at the Post Crash Economics convention at the University of Manchester, where he began by asking a very simple question – “What is money?” It’s a simple question, but it’s quite hard to answer without resorting to a vague functional description of what it does, i.e. “it is currency and we need it to buy things”. Alarmingly, he suggests that even some of top dogs within the financial industry have a hard time describing it, and these are the people running our economy. Anything can be ascribed a functional or technical description, but the one which we use depends on our understanding of the topic in question. For example many of us who lack technical understanding of a smartphone, would probably say something like “it’s an electronic device for making calls and texts and browsing the internet”. However, someone with a more technical understanding, an engineer perhaps, may describe how the phone works electronically and how each component functions in conjunction with one another, so as to facilitate the phones functions, giving the operator the capacity to make calls, texts and browse the internet. The problem is, even the people who claim to have knowledge of money lack this capacity to define it.

Usually money is regarded as a ‘store of value’ which allows us to purchase goods and services in payment for our labour. However, Brett argues that this is not the case and that money is merely an individual’s claim on something of value. Ultimately, money has no value – the only things that hold value are natural resources and the labour which makes them available to other people. Think of it like this. If you burn all of your money this has no effect on the value of the products in a shop. The products remain available and still ‘of value’ for other people to buy. What changes is your claim on those things of value as you can no longer buy them. Conversely, if we decided to set the shop on fire and destroy all the products, yet your wallet remains in-tact, then your claim on value does not change. But the destruction of the shop and the valuable items inside renders any cash you have completely obsolete, meaning money has zero value. Nothing! Zilch. Nada. Unless of course you need to burn it in order to keep warm.

So now that we’ve established that money simply substantiates an individual’s claim on value, how does it do it? Well, it exists as proof of your right to such a claim, whether the money was obtained as a gift or from paid labour. It acts as a medium of exchange between two parties by quantifying the amount of value which is redeemable, based on individual’s labour. The condition of the exchange is that the value of the product or service is equal to or less than the claim being made by the individual. By offering payment you are saying to the vendor “this is how much value I am allowed to claim, so I would like something of equal value in return”. One could therefore define it as “an arbitrary unit of currency which quantifies an individual’s claim to things of value. It binds two parties into a contract of exchange, whereby an individual substantiates their claim for products and services by presenting it as evidence in the form of cash or credit.”

By deconstructing the concept of money in this way, we achieve an understanding of its plasticity which is further endorsed when we consider the number of different currencies in operation around the world. Each work in the exact same way but where they differ is the degree in which they quantify value, and the jurisdictions under which they can be used. For example, the Dinar can only be used in Algeria, the Lira in Turkey, and the Pound Sterling in the UK. Each of these different jurisdictions keeps the exchange of value localised within their nations by using separate currencies to facilitate economic productivity and security. With currencies such as the Euro, which operates across 19 of the 28 Eurozone member states, it amalgamates the economies of many different nations into one big centralised economy, meaning that economic problems and prosperity of one nation are shared by all others who may not be experiencing the same conditions. But it also means that wealth is often redirected toward the individual with the strongest productivity, in this case Germany.

Similarly, these factors also operate on a smaller scale within individual nations, whereby investment is directed disproportionately to a nation’s capital city. The UK’s financial services industry is the bedrock of UK prosperity, operating mostly from within the capital. It is no surprise, then, that London and the south see the greatest proportion of infrastructure spending than anywhere else in the country. But in doing so, London is essentially using the rest of the country’s wealth to pay for its own upkeep, rather than equally re-distributing national wealth for reinvestment purposes. But this is something that has always been the same and investors will always follow the trail of money. Devolution is one way in which this issue can be addressed, but a more direct way is the introduction of an alternative currency that works within a much more localised environment.

You may have seen or heard things about the Brixton pound (B£) on the grapevine, maybe you’ve even used it before. It’s a relative new currency which was devised in 2008 in the wake of the financial crisis, but came to the streets of Brixton, London in 2009. The principle behind B£ was inspired by the negative effects that the economic collapse had on local business in the area, many of which began to struggle as a result. The founders wanted to provide a platform on which to support local businesses and establish stronger local trade networks, in order to protect the local economy and the local people from economic turmoil, and to improve social relations and community cohesion. They devised the idea for the alternative currency as a social project, allowing payments for products and services to be in the form of B£ to keep money within Brixton. They encouraged businesses to offer deals and discounts for people utilising the currency in order to establish strong foundations. Once enough people were on board, other businesses began recognising the positivity and as a result, the recognition of the Brixton pound as an alternative and legitimate ‘claim on value’ fell into place naturally. Now over 250 local business are involved in the project – not bad for 7 years work.

The underlying feature is that B£ removes the wealth creation from the central and commercial banks and allows wealth to propagate locally. This is not the first instance of a local currency. Cornwall, Bristol, and a number of others all exhibit their own local currency, but it has inspired the creation of similar ventures in places such as Hackney and Oxford. Liverpool is also on the verge of introducing its own currency in order to keep money within the ‘pool’ and “out of complex financial markets”. As stated on their website ‘liverpool-pound.org’, encouraging local trading reduces the need for inefficient long distance transport, and thus supports a low carbon economy. And it’s these very practices that need to be the forefront of local economies.

As a leading centre for business investment and the largest city in the north, Manchester could benefit significantly from a local currency. Let’s not wait on ceremony for the government to promote their own idea of devolution, perhaps it’s time for Manchester to take control of its own destiny, starting with its economy. The city is huge but poorly connected. Encouraging local trade within Manchester and greater Manchester will ensure that we take control of our own investments, and improve infrastructure based on the needs of the city, which will themselves be dictated by local trade. We can more directly support sustainable practices and community integration by giving power to small business and social enterprise, in order to give power back to the people. Using a platform for a low carbon economy which the city is currently trying to advocate, a local currency could be implemented to support and help nurture new sustainable business ideas which can help in combatting climate change at a local level. We can’t hope to change the world, nor can we change the entire country, but we can at least work together to change the way our own city works. We can make it work for us, the people and small businesses, as opposed to the big banks, large corporations, and shareholders.

They say money talks, so maybe we could make one that speaks for the people of Manchester; give Mancunians their own claim on value. Our very own Manchester Pound.

Photo Credit: Post-Crash Economics Society, University of Manchester

Filed under: Politics

Tagged with: brett scott, convention, economics, lecture, local currency, manchester, post-crash economics, student activism

Comments